The payback period calculation tells us it will take him 6 years to get his money back. When he does, the $720,000 he receives will not be equal to the original $720,000 he invested. This is because inflation over those 6 years will have decreased the value of the dollar. No such discount is allocated for in the payback period calculation.

Investment

The payback period is calculated by dividing the initial capital outlay of an investment by the annual cash flow. The formula to calculate the payback period of an investment depends on whether the periodic cash inflows from the project are even or uneven. There are two types of payback periods – short time payback period and long time payback period. For a short time payback period, a higher cash inflow is required in the initial stage. Conversely, the long-time payback period provides a higher cash inflow at a later stage, so more time is required to recover initial investment in comparison. The break-even point (the point at which initial investment is recovered and profitability is attained) is an important factor.

Free Financial Modeling Lessons

In its simplest form, the formula to calculate the payback period involves dividing the cost of the initial investment by the annual cash flow. According to payback method, the project that promises a quick recovery of initial investment is considered desirable. If the payback period of a project is shorter than or equal to the management’s online bookkeeping services for small businesses bench accounting maximum desired payback period, the project is accepted, otherwise rejected. For example, if a company wants to recoup the cost of a machine within 5 years of purchase, the maximum desired payback period of the company would be 5 years. The purchase of machine would be desirable if it promises a payback period of 5 years or less.

- Any investments with longer payback periods are generally not as enticing.

- As a result, payback period is best used in conjunction with other metrics.

- The breakeven point is the price or value that an investment or project must rise to cover the initial costs or outlay.

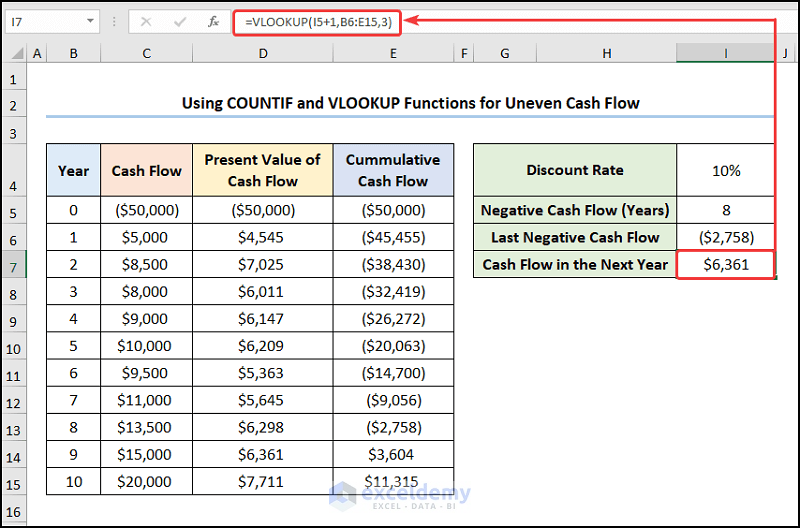

- In this article, we discuss how to calculate the payback period on an investment with uneven cash flows in Excel.

Payback period formula for even cash flow:

This is a particularly good rule to follow when a company is deciding between one or more projects or investments. The reason being, the longer the money is tied up, the less opportunity there is to invest it elsewhere. Unlike net present value , profitability index and internal rate of return method, payback method does not take into account the time value of money. A modified variant of this method is the discounted payback method which considers the time value of money. Under payback method, an investment project is accepted or rejected on the basis of payback period.

This means that it will actually take Jimmy longer than 6 years to get back his original investment. The Payback Period Calculator can calculate payback periods, discounted payback periods, average returns, and schedules of investments. Advantages – The payback period method is simple to calculate, so it give a ‘gut feel’ for timelines around the return of the initial investment. Delta Company is planning to purchase a machine known as machine X.

Years to Break-Even Formula

The PbP answers the question how much time it takes until thecumulated net cash flows offset the initial investment. But there are a few important disadvantages that disqualify the payback period from being a primary factor in making investment decisions. First, it ignores the time value of money, which is a critical component of capital budgeting. For example, three projects can have the same payback period with varying break-even points due to the varying flows of cash each project generates. Payback period is the time in which the initial outlay of an investment is expected to be recovered through the cash inflows generated by the investment. Let’s say Jimmy does buy the machine for $720,000 with net cash flow expected at $120,000 per year.

Chose the type of cash flows, fill in the initial investment and your forecasted even or uneven cash flows. The cash flows of most investments otherthan financial instruments and deposits are uneven. Hence, the amount of thenet cash flows varies among the periods within a forecast time horizon. Also,the cumulative cash flow can move bi-directional, e.g. starting in a negativevalue range, switching to a positive value and falling back under 0 over time.

Let’s say the net cash flow amount is expected to be higher, say $240,000 annually. This means it will only take 3 years for Jimmy to recoup his money. It is predicted that the machine will generate $120,000 in net cash flow every year.